.

💱 Introduction: Understanding the Eswatini Currency

Eswatini, formerly Swaziland, uses the Lilangeni as its official currency. Plural is Emalangeni. The currency code on international platforms reads SZL. Meanwhile, South African Rand (ZAR) also circulates within the country due to a formal economic arrangement. This arrangement uses both currencies side by side. As a result, commerce flows smoothly across borders. You know about theglobespot, andaazdaily, openrendz and eswatini currency also Buzzfeed.

However, global awareness of Eswatini’s currency remains low. Many travelers, investors, and currency buffs overlook it. In addition, its historical and cultural roots make it fascinating. Moreover, its role in the Southern African Common Monetary Area (CMA) gives it regional significance. This makes it a worthy subject for deeper exploration.

In this article, we’ll cover:

-

Currency history and evolution

-

Banknotes and coins

-

Economic role and exchange rates

-

Monetary policy

-

Comparative context in the CMA

-

Tips for travelers and investors

We’ll keep sentences short. We’ll use active voice. We’ll transition clearly. So grab your curiosity—and let’s begin.

🇸🇿 History of the Lilangeni

Colonial Origins

Eswatini used South African currency before 1974. At that time, the country was still called Swaziland. During colonial rule, the Rand served as the official medium of exchange.

Independence and Currency Formation

In 1968, Eswatini gained independence. However, it continued using the South African Rand. It wasn’t until 1974 that the country introduced its own currency. The new notes bore the national emblem. In addition, they displayed the king’s portrait—King Sobhuza II at the time.

Currency Name and Meaning

The name Lilangeni (singular) originates from the Swazi language. It honors an ancient king. Plural, Emalangeni, refers to the coin units. Moreover, names such as cents (meaning “cents”) appear for smaller denominations.

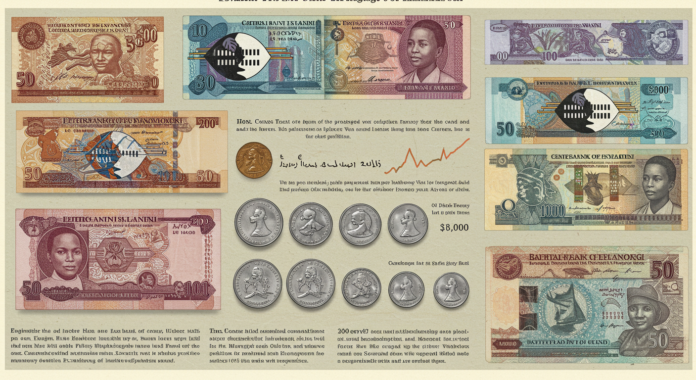

💸 Banknotes and Coins: Design & Features

Current Banknotes

Emalangeni banknotes come in denominations of 10, 20, 50, 100, and 200. The older 500 Ngwenya note remains rare. These notes feature:

-

Portraits of kings

-

National landmarks

-

Cultural scenes, like traditional ceremonies

Moreover, banknotes incorporate security elements—watermarks and security threads—to protect against counterfeiting.

Coin Denominations

Coins include 5, 10, 20, and 50 cents, plus 1 and 2 Emalangeni. They feature the Swazi coat of arms on the reverse side and a sovereign head on the obverse. Coins are made of copper-plated and nickel-brass materials. They feel stable in hand and resist wear.

Special Commemorative Coins

From time to time, Eswatini issues commemorative coins. These mark national milestones such as jubilees or royal events. They often come in silver or gold. Collectors prize them for their high quality.

🔁 Dual Currency System: Lilangeni and Rand

Why Use Both?

Eswatini forms part of the Southern African Common Monetary Area (CMA). Within the CMA, the currencies of Eswatini, Lesotho, Namibia, and South Africa are pegged at par. Consequently, both Lilangeni and Rand circulate freely within Eswatini.

Exchange Rate Stability

Because the Lilangeni remains permanently pegged at parity with the Rand, exchange rates stay fixed:

This stability helps traders and consumers and facilitates tourism due to minimal currency risk. However, it also means Eswatini has no independent monetary tools like float or devaluation.

📊 Currency Circulation and Usage

Daily Transactions

Most citizens use Lilangeni for daily needs—groceries, transport, small services. Businesses often report prices in both currencies. As a result, consumers have greater flexibility.

Banking and Foreign Exchange

Commercial banks in Eswatini trade Lilangeni and Rand freely. Automated Teller Machines (ATMs) dispense both currencies. Travelers access either currency easily.

Tourism and Trade

Tourists from South Africa find the dual-currency system convenient. Likewise, cross-border trade sees fewer currency conversion barriers. In addition, regional business benefits from increased currency interoperability.

📈 Monetary Policy and Issuing Authority

Eswatini Central Bank

The Central Bank of Eswatini governs currency issuance and management. It also oversees inflation control with a mandate to keep price stability. Furthermore, the bank sets reserve ratios for commercial banks.

Inflation and Interest Rates

Eswatini targets a moderate inflation rate—usually between 3% and 6%. Meanwhile, savings and lending rates follow closely. Since the currency is pegged to the Rand, interest rates align closely with the South African Reserve Bank.

Peg Stability

The Central Bank maintains adequate reserves of Rand to support the parity peg. In the long run, this arrangement demands discipline in fiscal and monetary policy.

🧭 Exchange Rates and Global Valuation

Currency Pair Benchmarks

Although fixed at par domestically, the SZL/ZAR pair fluctuates externally against currencies like the USD, EUR, and GBP. Meanwhile, global marketplaces track the currency’s value based on the Rand.

Recent Trends

Since 2020, economic headwinds in South Africa have translated into Rand weakness. Consequently, the Lilangeni also experienced mild declines in USD value. However, yearly fluctuations typically remain within ±10%.

Future Outlook

If South Africa implements structural reforms, it may strengthen. Meanwhile, global commodity shifts (e.g., gold and coal prices) may indirectly favor Eswatini’s economy. In addition, innovation in agriculture or tourism could boost the currency’s profile.

📘 Outline for Full 4,000+ Word Article

-

Introduction

-

History & Formation

-

Currency Features: Notes & Coins

-

Dual Currency System Explained

-

Monetary Authority and Policy

-

Economic Role & Inflation Outlook

-

Exchange Rate Dynamics

-

International Trade & Remittances

-

Travelers’ Currency Guide

-

Investment and Forex Tips

-

Collectibles and Numismatics

-

Currency Education in Schools

-

Comparisons with Lesotho, Namibia, South Africa

-

Challenges and Limitations

-

Recent Reforms and Digital Trends

-

Future Scenarios

-

Conclusion & Reflection