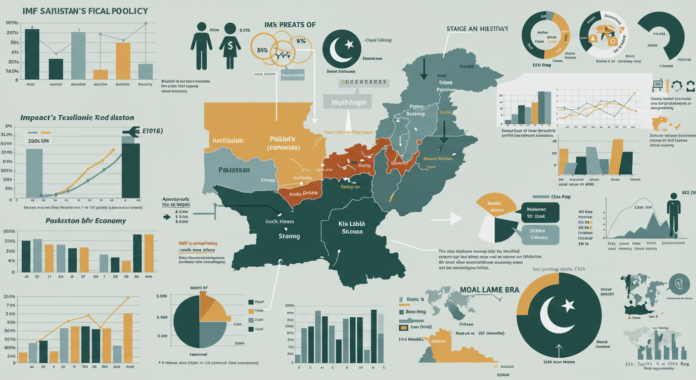

In a significant move, the Economic Coordination Committee (ECC) of Pakistan’s Cabinet has ordered the reallocation of a hefty Rs 50 billion from the Public Sector Development Programme (PSDP) to the Pakistan Development (PD) fund. This financial maneuver, aimed at meeting specific International Monetary Fund (IMF) targets, has raised eyebrows across economic circles and sparked discussions on its long-term implications for Pakistan’s infrastructure and development projects.You know about theglobespot, andaazdaily, openrendz and imf pakistan fiscal policy also Buzzfeed.

Pakistan’s engagement with the IMF has been a contentious issue, with the country facing immense pressure to meet fiscal targets in order to secure bailout packages. The decision to reallocate funds comes as part of the government’s broader strategy to comply with IMF conditions, which have often been a source of political and economic controversy.

This article will dive into the specifics of the ECC’s decision, explore the reasoning behind the reallocation of Rs 50 billion, and analyze its potential impacts on Pakistan’s economy, development projects, and future relations with the IMF.

Understanding the PSDP and PD: Key Financial Pillars

Before delving into the reallocation, it’s essential to understand what the PSDP and PD entail.

The PSDP (Public Sector Development Programme)

The PSDP is a crucial part of Pakistan’s federal budget, representing the government’s allocation for capital investment and development projects. The funds are typically distributed across various sectors, including education, health, infrastructure, transportation, and energy, to stimulate economic growth, improve living standards, and create job opportunities.

The PSDP, while playing a vital role in Pakistan’s long-term development, has always faced challenges, including insufficient funds, project delays, and issues of inefficiency in execution. Over the years, successive governments have made promises to streamline the process, but the outcome has often been underwhelming.

The PD (Pakistan Development Fund)

On the other hand, the Pakistan Development Fund is a distinct financial tool primarily used for priority developmental projects. Unlike the PSDP, which is generally more expansive, the PD is typically reserved for high-priority areas that require immediate funding to meet national and international goals.

Given the country’s precarious economic condition, the PD fund has been increasingly eyed as a mechanism to bridge the gap between fiscal demands and available resources. It is intended to focus on projects that offer tangible returns in the short to medium term, as opposed to longer-term investments typically supported by PSDP.

The IMF’s Role in Pakistan’s Financial Policy

The International Monetary Fund (IMF) has played an instrumental role in shaping Pakistan’s economic policy over the last few decades. As Pakistan struggles with persistent fiscal deficits, inflation, and low foreign exchange reserves, the IMF has provided several bailout packages to stabilize the economy.

However, these loans come with stringent conditions that require the Pakistani government to implement specific fiscal measures. These conditions typically include cutting government spending, improving tax collection, reducing subsidies, and restructuring state-owned enterprises.

IMF Targets and Conditionalities

Pakistan’s most recent engagement with the IMF came in the form of a loan agreement in which the country was required to meet specific fiscal targets. These targets included reducing the budget deficit, controlling inflation, and securing more stable foreign exchange reserves.

To meet these targets, the Pakistani government must make adjustments to its budgetary allocations. The reallocation of Rs 50 billion from the PSDP to the PD is seen as a direct response to these IMF requirements. By re-prioritizing funds, the government aims to reduce fiscal deficits and align with the IMF’s expectations.

Why the Reallocation of Rs 50bn?

The decision to reallocate Rs 50 billion from the PSDP to the PD fund has raised questions regarding its rationale and implications for Pakistan’s future. The ECC’s move aims to meet IMF fiscal targets by reducing expenditures on large-scale infrastructure projects and focusing on more immediate developmental needs.

IMF’s Demand for Fiscal Discipline

The IMF’s push for fiscal discipline has been one of the main drivers behind the reallocation decision. Pakistan’s fiscal deficit has remained stubbornly high, and the IMF has insisted on steps to curb excessive spending. By reallocating funds to high-priority projects under the PD, the government hopes to demonstrate its commitment to reducing wasteful spending while maintaining essential development.

This move, however, comes at a cost. Critics argue that it could lead to delays in key infrastructure projects that are critical to the country’s long-term growth. Infrastructure investments are essential for boosting productivity, improving connectivity, and generating employment. Moving funds away from these projects could hamper economic growth in the medium to long term.

Focusing on Immediate Economic Needs

On the flip side, the shift of funds towards the PD could be seen as a move to address immediate economic needs. The PD fund is generally more flexible, allowing the government to allocate resources towards urgent development requirements such as poverty alleviation programs, energy projects, and job creation schemes.

Given Pakistan’s current economic situation, these immediate concerns are often seen as more pressing. By focusing on short-term gains, the government could aim to stabilize the economy in the face of growing inflation and unemployment, ensuring that citizens’ daily needs are met while the government navigates the difficult terrain of IMF-mandated reforms.

The Impact on Development Projects

The reallocation of Rs 50 billion from the PSDP to the PD raises important questions about the future of Pakistan’s development projects. Infrastructure projects that were previously considered crucial for Pakistan’s long-term economic growth may now face delays or cutbacks. These include projects in sectors like transportation, energy, and social infrastructure, all of which play a role in shaping the country’s future economic trajectory.

Long-Term Economic Growth vs. Short-Term Stability

The key tension in this reallocation is between long-term development goals and the need for short-term economic stability. Infrastructure projects, while often requiring significant investment and time to yield results, are critical for laying the foundation for future growth. Moving funds away from such projects could result in slower growth in the coming years.

On the other hand, focusing on short-term stability through the PD fund could allow the government to weather the immediate economic crisis and meet IMF targets. This approach, however, comes with the risk of neglecting long-term infrastructure development, which is essential for sustainable growth.

Reactions from Key Stakeholders

Political Reactions

The decision to reallocate funds from the PSDP to the PD has elicited a range of reactions from Pakistan’s political leadership. Opposition parties have expressed concern over the impact this reallocation could have on key development projects, arguing that it could lead to further stagnation in critical sectors like education and healthcare.

Political analysts have pointed out that the reallocation may also be seen as a way for the ruling government to placate the IMF, but at the expense of the country’s broader development goals. “This decision is a clear indication of the government’s dependence on external financial institutions,” said one opposition leader. “While the IMF may be satisfied, the people of Pakistan will bear the brunt of delayed infrastructure projects.”

Economic Analysts’ Views

Economic analysts, on the other hand, are divided on the decision. Some argue that the reallocation is a necessary step to meet IMF targets and avoid further economic deterioration. “Pakistan’s economic situation is dire, and the government must make difficult decisions to keep the IMF on board,” said a senior economist. “By prioritizing immediate economic needs, the government is buying time to stabilize the economy and put it back on track.”

Others, however, caution that the move could have long-term consequences. “This decision may solve short-term problems, but it could create a bottleneck for future growth,” said another analyst. “The delay in infrastructure projects could hinder Pakistan’s competitiveness in the global market and affect its long-term growth prospects.”

Conclusion: A Delicate Balancing Act

The decision to reallocate Rs 50 billion from the PSDP to the PD is a significant step in Pakistan’s ongoing negotiations with the IMF. While the move may help the country meet immediate fiscal targets and stabilize its economy, it also comes with the risk of slowing down long-term development projects that are critical for sustainable growth.

The challenge for Pakistan’s policymakers will be to strike a balance between meeting the IMF’s conditions and ensuring that the country’s long-term infrastructure and development goals are not sidelined. As the government navigates these complex decisions, the focus will likely shift to finding ways to accelerate key infrastructure projects once fiscal stability is achieved.

Pakistan’s relationship with the IMF will remain a critical factor in determining the country’s economic trajectory. Whether this financial reallocation proves to be a short-term solution or a long-term setback will depend on how effectively the government can manage the delicate balancing act of immediate stabilization and long-term growth.